If you're self employed HMRC will allow you to claim for the cost of business journeys in two ways:

1) A percentage of all your car expenses based on the proportion of business miles you do. You may also be able to claim for the cost of your car as well.

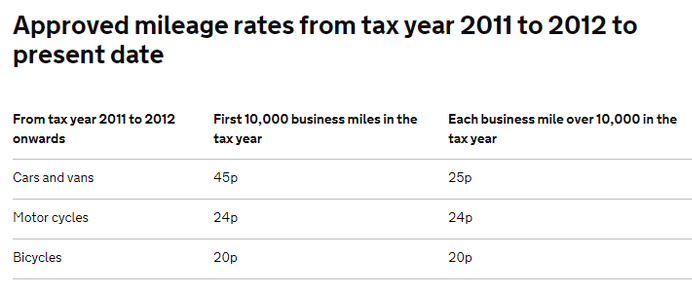

2) An approved mileage rate, which includes the cost of buying your car.

If you operate as a limited company you can still claim on the mileage basis but if you choose the other basis because the car expenses are paid for by the company you will be treated as being provided with a company car and taxed accordingly.The personal tax bill in a large number of cases exceeds any tax saved by the company.